24+ why does mortgage go up

It was a 30-year fixed rate with FHA. Web 1 day agoThe rate on the average 30-year fixed mortgage hit 708 up from 694 the week prior according to Freddie Mac.

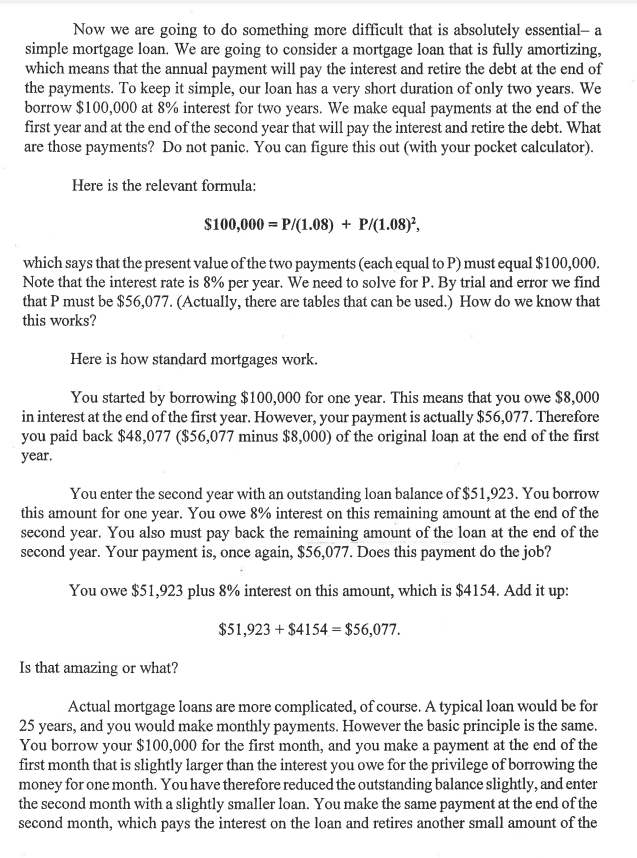

Mortgage 101

These are the reasons that your mortgage.

. Web 2 days agoThe Bank of England has upped base rate from 4 per cent to 425 per cent the latest decision by its Monetary Policy Committee in a bid to curb inflation. The result is a home that is free and clear. However if you have a.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. The assumption is that employed people have. Web The BoE is expected to hike interest rates to 425.

Web Economic growth indicators such as gross domestic product GDP and the unemployment rate influence mortgage rates. Web If youre wondering whether your mortgage payments can go up the answer is yes but only if you have an adjustable-rate mortgage ARM. Web Declining consumer prices are one reason the Fed might stop raising and start cutting.

Photo by Joe. Web This of course is a very easy situation to avoid. Web Mortgage rates had been on an upward trajectory in 2023 with annual percentage rates or APRs on 30-year fixed-rate loans firmly in 7 territory right around the time Powell spoke before Congress.

And banks recent troubles mean they could soon. An unexpected rise in the UKs inflation rate has led the Bank of England BoE to up interest rates for the eleventh time in a row. Discover The Answers You Need Here.

Inflation has fallen to 6 from its June 2022 high of 91. Web Why Did My Mortgage Payment Go Up Your mortgage payment may have increased due to an increase in your taxes andor insurance bill. Check your monthly mortgage statement.

He had made the minimum down payment required for the FHA loan we had arranged for him. Changes in your property taxes or homeowners insurance are two of the most common reasons for a mortgage payment increase. With an ARM your interest rate and monthly payments will change over time.

These funds are held in an escrow account included with your mortgage. We had helped Ralph Vanderplatz buy his first home the year before. Web 3 reasons your escrow payment might be going up Your lender will recalculate your escrow payment every year and it is possible that your escrow payment will change.

An increase in homeowners. Web If your mortgage has an impound account your total housing payment could go up An impound account results in homeowners insurance and property taxes being paid monthly If those costs rise from year to year your total payment due could also increase. The escrow portion of your payment is based on the last tax andor insurance payment made from your escrow.

To understand why this is you need to know that most mortgages are packaged and sold as securities on Wall Street. Web If your monthly mortgage payment includes the amount you have to pay into your escrow account then your payment will also go up if your taxes or premiums go up. Web This is another reason that makes your mortgage payment go up.

Web Has your mortgage just gone up you dont know why. Web Why does my mortgage balance keep going up. Web Fixed-Rate Mortgage Payments Can Still Change.

Mortgage rates tend to rise during periods of economic growth and low unemployment. Sponsored Check Todays Mortgage Rates at Top-Rated Lenders. Common reasons your escrow payment might be going up include.

Dont Settle Save By Choosing The Lowest Rate. This is probably because the lender has charged you fees that cause the increase. To be more precise itd shave nearly 12 and a half years off the loan term.

Mortgage rates surpassed 7 for the first time since April 2002. You have a decrease in your interest rate or your escrow. Sponsored It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Compare Apply Directly Online. Web Paying an extra 1000 per month would save a homeowner a staggering 320000 in interest and nearly cut the mortgage term in half. Learn more about escrow payments.

Lock Rates For 90 Days While You Research. Find out how to save 000 every year on your mortgage and avoid payments going up. The lender may make you pay more than your usual monthly dues.

Web Mortgage rates typically move similarly to 10-year Treasury bond yields so when yields go up so do mortgage rates. Web This assumes they have 20 years left on their interest-only mortgage and their monthly bill would be 848 while repayment-only mortgage holders will be paying 1101 up from 1080 an. It is the Bank of Englands eleventh.

Make sure to pay our mortgage every month and consider setting up automatic payments so you dont have to remember to send a payment.

Why Did My Mortgage Go Up Rocket Mortgage

Cmp 15 11 By Key Media Issuu

Mortgage Lending Officer In Princeton Nj

Nicole Johnson Senior Mortgage Loan Officer Movement Mortgage Linkedin

Mortgage Loan Mbc

Biggest Rally In Over A Decade After Cpi Overdelivers

Five Million Uk Families Face Mortgage Rising By 5 100 A Year By End Of 2024 Mortgage Rates The Guardian

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

290f Bukit Batok Street 24 Hdb Flat For Sale 1 302 Sqft 99 Co

Now We Are Going To Do Something More Difficult That Chegg Com

Your Local Mortgage Broker Mornington Team Mortgage Choice

Amortization Fascination And Infuriation Life On Virginia Street

Premium Photo Approved Mortgage Loan Agreement Application

Now We Are Going To Do Something More Difficult That Chegg Com

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

How Much Money Can I Afford To Borrow For A Mortgage

Why Did My Monthly Mortgage Payment Go Up